maine excise tax form

This calculator is for the renewal registrations of passenger vehicles only. If you are renewing an existing registration the MSRP is called the Base Price on your current registration form upper right-hand corner of the registration document.

Kansas Ranks In Top Half Of States With Most Burdensome Taxes

The state collects about 25 million in CFET tax each year.

. YEAR 3 0135 mill rate. An excise tax is imposed on the privilege of manufacturing and selling wine in the State. To find the MSRP if you do not have an existing registration on hand.

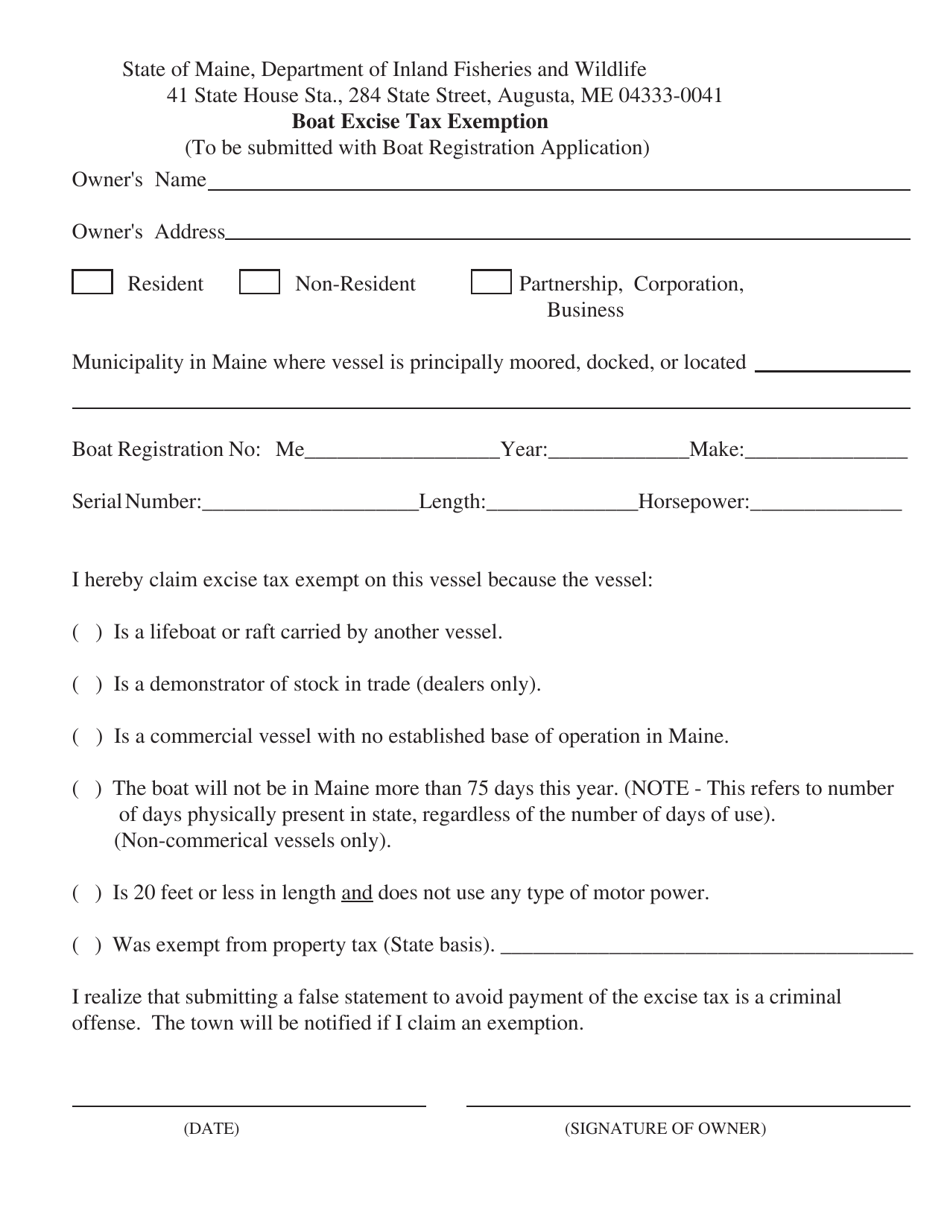

2020 -- 1350 per 1000 of value. Navigate to MSN Autos. Boat Excise Tax Exemption Form.

You many be able to find the MSRP online at sites such as MSN Autos or Kelley Blue Book. IRP Uniform Distance Schedule -. Except as provided in subsection 2-A the in-state manufacturer or importing wholesale licensee shall pay an excise tax of 60 per gallon on all wine other than sparkling wine fortified wine or hard cider manufactured in or imported into the State 124 per gallon on all sparkling wine.

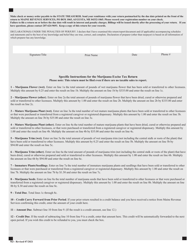

Form or that the fuel or electricity purchased will not be used by the purchaser for qualifying activities or support operations. Total Excise Tax Due multiply line 7 by 035 thirty-five cents 8. 2019 -- 1000 per 1000 of value.

A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. YEAR 6 0040 mill rate. The excise tax due will be 61080.

You can also call the dealership that the vehicle was purchased from. Home of Record legal address claimed for tax purposes. Accident Report Form - Watercraft.

Real Estate Withholding REW Worksheets for Tax Credits. Simplify compliance with automation software designed to work together seamlessly. IFTA Fuel Tax Form 3rd quarter 2020.

2018 -- 650 per 1000 of value. It is NOT necessarily what you paid for the vehicle. Spinney Creek Tide Gate Schedule - 2022.

Individual Vehicle Mileage and Fuel Report. To find the MSRP of an existing registration. How is the excise tax calculated.

YEAR 2 0175 mill rate. Ad AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. The application and instructions for the Off-highway refund is found on the Fuel Tax Forms page.

This affidavit is valid for purchases of depreciable machinery or equipment including repair parts for qualifying machinery or. The rates drop back on January 1st of each year. This is the sticker price of the vehicle and its accessories.

Contact 207283-3303 with any questions regarding the excise tax calculator. When importing malt liquor into Maine. Excise tax paid on gasoline purchased in Maine and used for commercial purposes other than the operation of a registered vehicle on the highways of Maine may be eligible for a refund.

The MSRP is listed on your current registration form under Base. 2022 -- 2400 per 1000 of value. Calculation will be based on.

Boat Registration Form Use Tax Certificate required for new registrations Boat Dealer Registration. IFTA Fuel Tax Form 4th quarter 2020. Clear on-road diesel used for off road purposes also may be eligible for an excise tax refund.

2022 Watercraft Excise Tax Payment Form. 72 Consecutive Hour Trip Permit Application. 18 rows The purpose of the tax is to partially offset the costs of forest fire protection expenditures of the Department of Agriculture Forestry and Conservation.

YEAR 5 0065 mill rate. Bring in the following- Out of state title or Lien Holders Name and Address. 2021 -- 1750 per 1000 of value.

There are several ways to find the MSRP. The Form can be found at Bureau of Motor Vehicle Web site or the link below. You will be charged 33 for the Title application and 55 of the purchase price of the vehicle.

To apply for the exemption the resident must provide documentation by filling out The Active Duty Stationed in Maine Excise Tax Exemption Form. For example the owner of a three year old motor vehicle with an MSRP of. This individual is permanently assigned to the unit and station identified above is on active duty and is not a member of the Guard or Reserves.

The Maine cigarette tax of 200 is applied to every 20 cigarettes sold the size of an average pack of cigarettes. Permit to Harvest and Sell Sucker Packet 2021 Application 2021 Reporting Form 2021 Boats. Below you will find the Town of Eliot Boat Excise Tax Payment Form for downloadcompletion along with the Maine Watercraft Excise Tax Table for computing the boat excise tax due.

If a pack contains more then 20 cigarettes a higher. YEAR 1 0240 mill rate. There are about 750 accounts including over 9 million taxable acres.

Individual Income Tax 1040ME Corporate Income Tax 1120ME Estate Tax 706ME Franchise Tax 1120B-ME Fiduciary Income Tax 1041ME Insurance Tax. Title Application and Sales Tax Form will be given to you by the clerk. Maines excise tax on cigarettes is ranked 11 out of the 50 states.

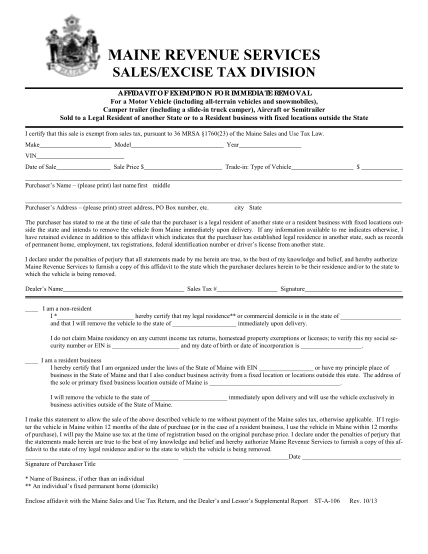

You may also be able to find the MSRP online at sites such as MSN Autos. MAINE REVENUE SERVICES SALESEXCISE TAX DIVISION AFFIDAVIT OF EXEMPTION. YEAR 4 0100 mill rate.

Commercial Forestry Excise Tax Return. Excise Tax Reimbursement Policy Procedures The State of Maine will reimburse Municipalities for the difference between the excise tax based on the sale price and the Manufacturer Suggested Retail Price MSRP on vehicles that are 1996 or newer and registered for a gross weight of more than 26000 lbs. 2022 Watercraft Excise Tax Payment Eliot Maine.

If previously registered out-of-state. Please contact our office 207-439-1817 with any questions or for assistance with the calculation of the excise tax due. 112 15041 excise tax shall be paid within 10 days of the first operation of the watercraft upon the waters or prior to July 1st whichever comes first.

Knowingly supplying false information on this form is a Class D Offense under Maines Criminal Code punishable by confinement of up to one year or. Pursuant to MRS Title 36 Ch. How much will it cost to renew my registration.

See also additional excise tax below Maine manufacturer When selling low-alcohol spirits products to a. 2017 Older -- 400 per 1000 of value. Under Used Cars select the make and.

2 Low-alcohol spirits products excise tax 124gallon spirits products to Maine retailers. The Maine excise tax on cigarettes is 200 per 20 cigarettes higher then 78 of the other 50 states. You must fill these out before completing the transaction.

HttpwwwmainegovsosbmvformsMV-720Active20Duty20Excise20Exemption20Formpdf To read the State law. Town of Eliot 1333 State Road Eliot Maine 03903 207 439-1813. IRP Application for Changes - Schedule C.

Boat Launch Season Pass - Piscataqua River Boat Basin. When offering samples at a taste-testing festival. Excise tax is calculated by multiplying the MSRP by the mill rate as shown below.

By signing this tax excise tax report the licenseeunderstands that false statements made on this are punishable by form law. Electronic Request Form to request individual income tax forms.

105 Form 2290 Tax Computation Table Page 5 Free To Edit Download Print Cocodoc

Pin By Rahul Prem Shakya On Safe Shop Online Marketing Pvt Ltd Online Marketing Business Signage Marketing

Excise Tax Information Cumberland Me

Dha Peshawar Balloting Date Plots For Sale Peshawar Job Ads

Candidates Who Have Applied For Delhi Forest Guard Vacancy 2021 They Can Download Admit Card At Its Official Webiste In 2021 Forest Department Recruitment Exam Papers

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Paying Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/ENON6OIQKBHMDEO73MYRMAF7X4.jpg)

Kansas Ranks In Top Half Of States With Most Burdensome Taxes

Ultimate Excise Tax Guide Definition Examples State Vs Federal

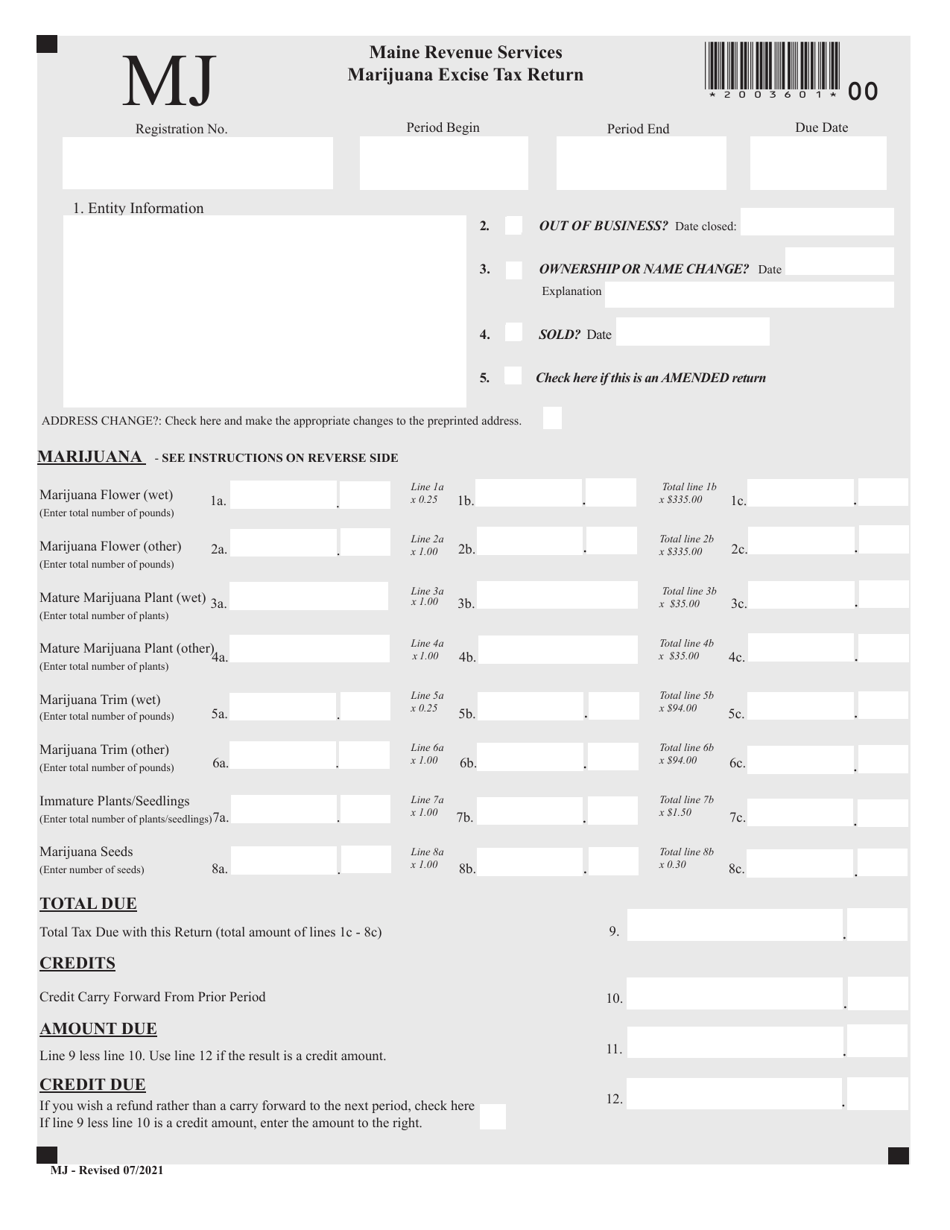

Maine Marijuana Excise Tax Return Download Fillable Pdf Templateroller

Pin On E Learning Online Mock Test

8 Invencoes Bizarras Porem Uteis Para Amantes De Cerveja Cerveja Invencoes Mike Tyson

Amazon Avoids More Than 5 Billion In Corporate Income Taxes Reports 6 Percent Tax Rate On 35 Billion Of Us Income Itep

Proposed Increase In Real Estate Excise Tax Results In Outpouring Of Public Input News Dailyrecordnews Com

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller

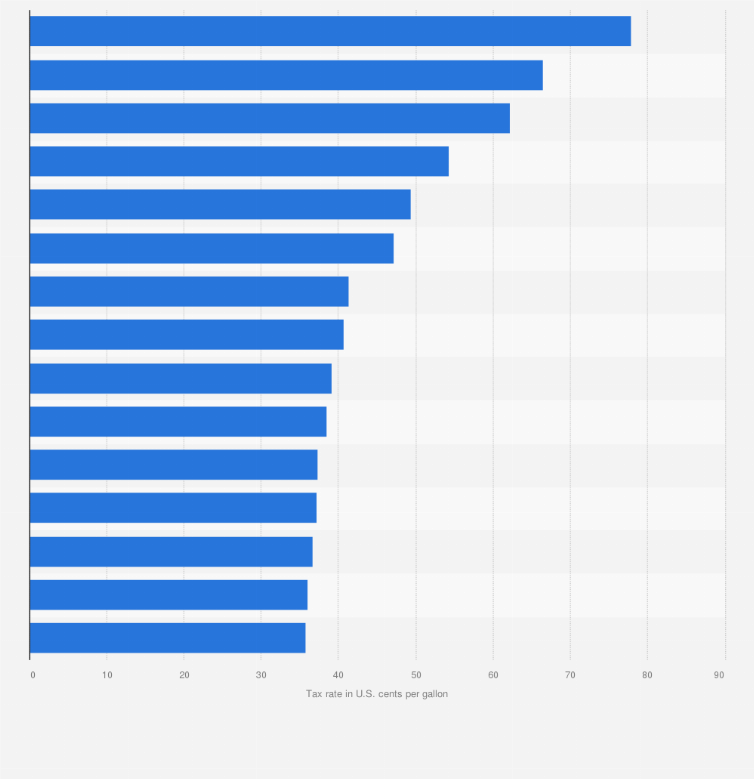

U S States With Highest Gas Tax 2022 Statista

Maine Marijuana Excise Tax Return Download Fillable Pdf Templateroller

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return